Commitment Pacing

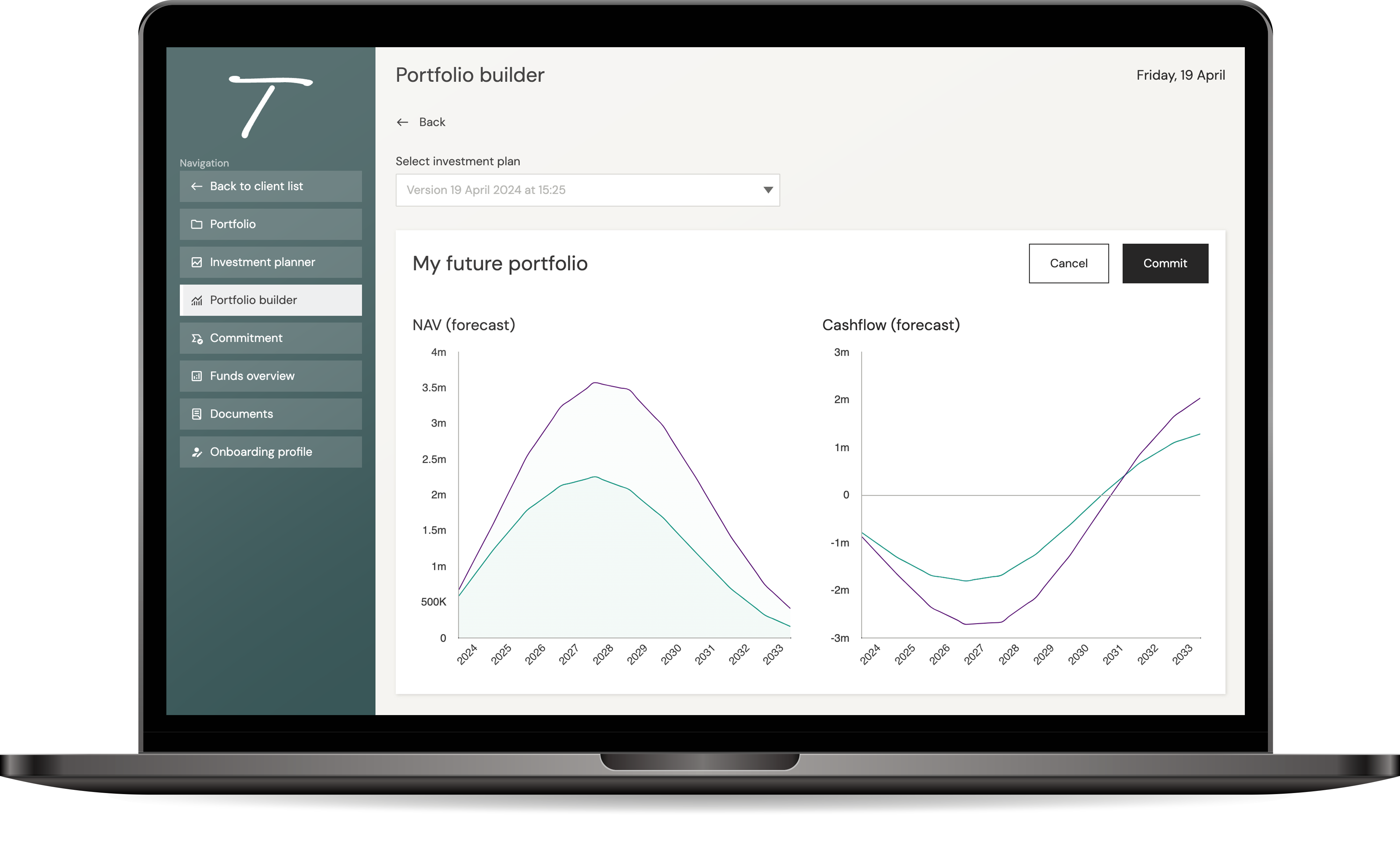

The nature of private markets fund investments, with capital calls and distributions, requires a disciplined approach to commitment pacing to hit targets. Being both over or under invested vs. target is sub-optimal. Commitment pacing refers to the development of an investment plan detailing how much an investor should commit each year to private markets to achieve their overall allocation / cash flow objectives. Troviq uses several cash flow planning tools to support our partners in developing commitment pacing plans to maximise the likelihood of being “at target” over the long term.